30+ mortgage points tax deduction

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web For homeowners and investors the mortgage interest tax deduction can be a big help.

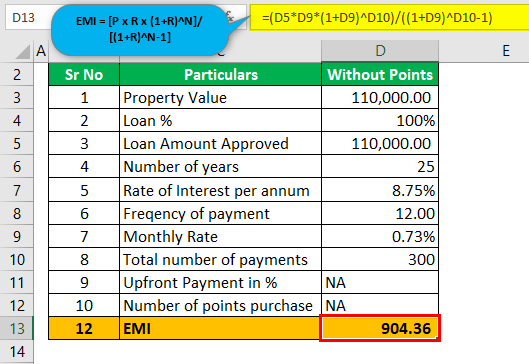

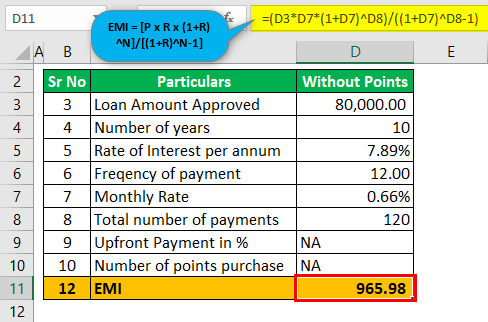

Mortgage Points Calculator Calculate Emi With Without Points

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

. Web Is mortgage interest tax deductible. Learn about the rules limits and how to claim it. Homeowners who bought houses before December 16.

With a 15-year loan you deduct one-fifteenth. Finance Your Dream Home with the Lowest Rates. Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000.

A homeowner paying points on a 30-year mortgage loan can claim 130 of. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Choose a Loan That Suits Your Needs.

However higher limitations 1 million 500000 if married. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan. Mortgage discount points also known as prepaid interest are generally the fees you. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Ad Taxes Can Be Complex. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web You can deduct the points in full in the year you pay them if you meet all the following requirements.

Ad Get the Best Rates For Your Mortgage Compare Top Companies and Get Great Deals. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad Taxes Can Be Complex.

Essentially you may be. Web With a 30-year mortgage you deduct one-thirtieth of the cost of the points each year. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The tax deduction for points paid on a refinance loan is spread over the life of the loan. Web Discount Points Deductions Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

Your main home secures your loan your main home is the one. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Private mortgage insurance Not so great news. Web Most homeowners can deduct all of their mortgage interest. Web About Tax Deductions for a Mortgage.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Business Credit Cards

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Points Calculator Calculate Emi With Without Points

Home Mortgage Loan Interest Payments Points Deduction

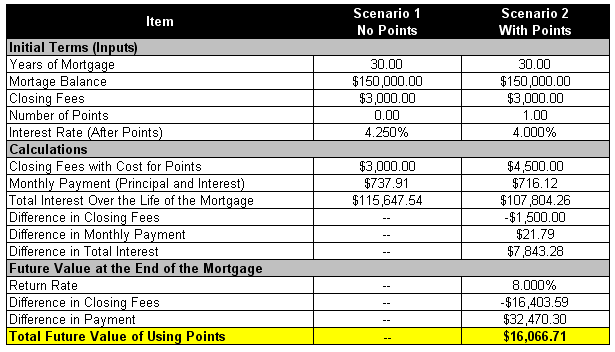

Which Is Better Points Or No Points On Your Mortgage

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

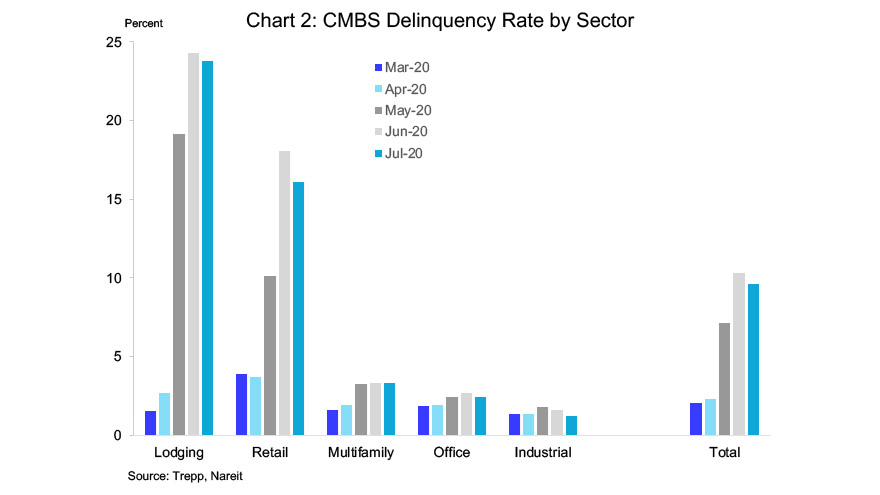

Cbms Delinquency Rate Drops In July Nareit

Qjmowu0mwyb5um

Which Is Better Points Or No Points On Your Mortgage

Discount Points Calculator How To Calculate Mortgage Points

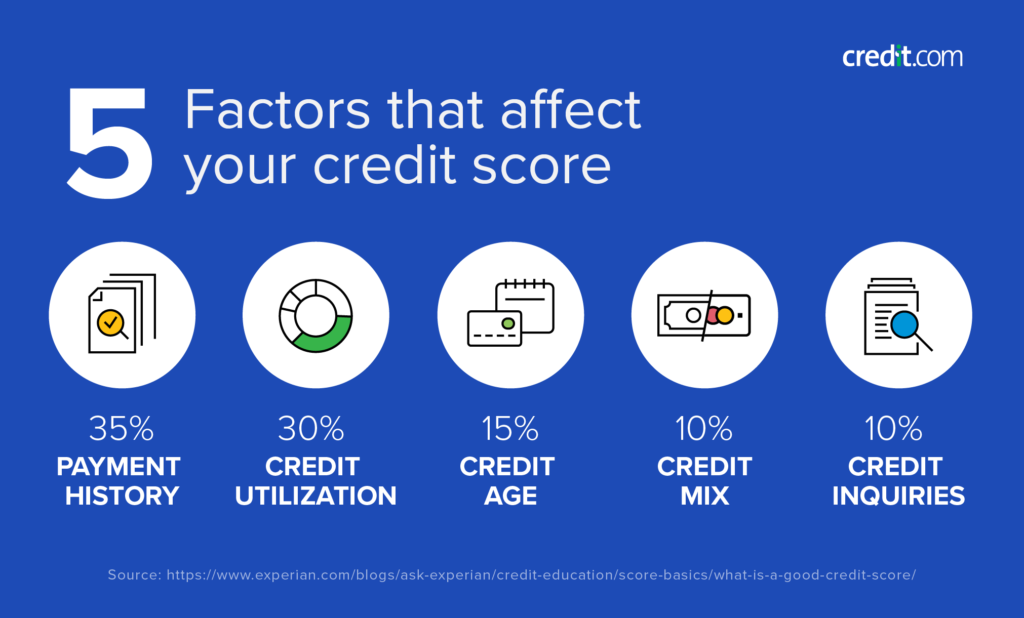

What Is The Average Credit Score In America Credit Com

1vcxjtf8hgbujm

Mortgage Points Are They Worth Paying Forbes Advisor

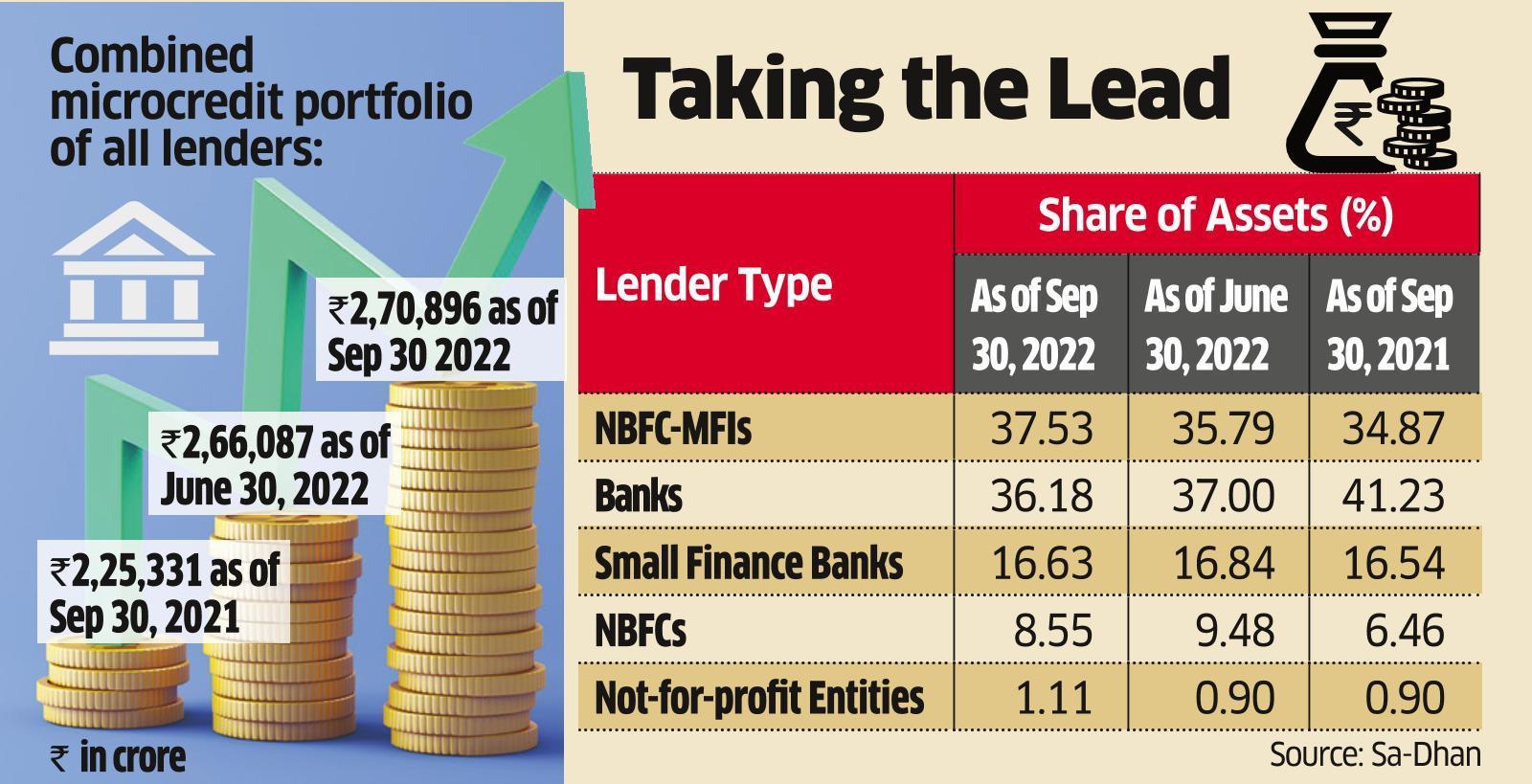

Nbfc Mfis Group Overtakes Banks In Microfinance Lending The Economic Times

Health Services Tax Conference Day Two